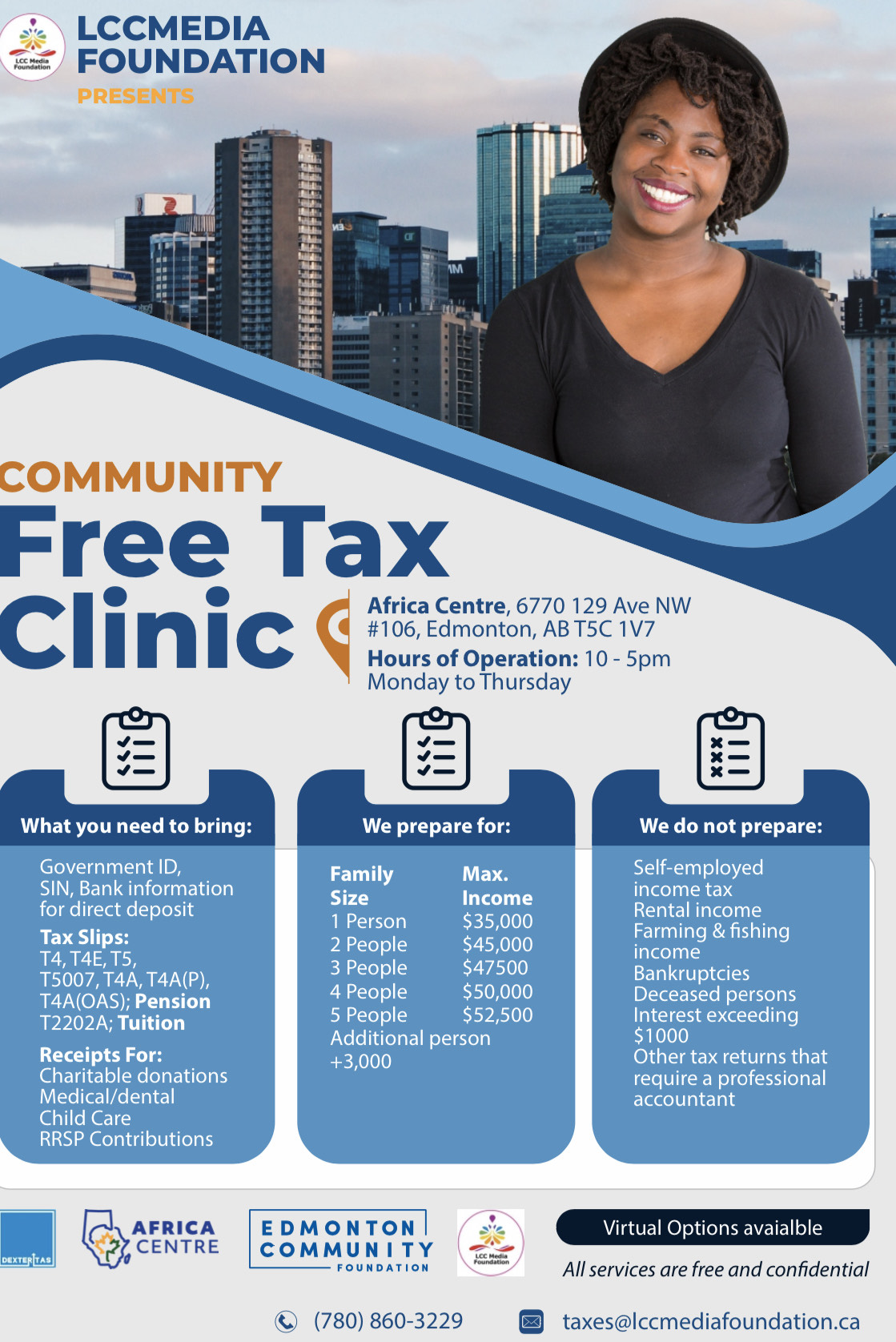

In partnership with Dexteritas Inc, LCCMedia Foundation started offering Low Income Community Free Tax Clinic on the 15th of February 2022. We would love the opportunity to invite Edmontonians to come...

Filing your taxes Government benefits The Working Income Tax Benefit (WITB), Canada Child Benefit (CCB) and GST/HST credit are only some of the benefits you can get once...

Benefits and credits provide income and financial support for many individuals. Tax credits and benefits are financial supports provided by the government to help you with living...

LCCMedia Foundation and Dexteritas Inc are pleased to announce that they will be launching a free tax clinic from the 15th of February 2022. From their work...

Ongoing Series from Canada.ca The Canada child benefit, or CCB for short, is a tax-free monthly payment that helps with the cost of raising children. You may...

Do you have to file a return If you’ve only lived in Canada for part of the year, you may still have to do your taxes. There are...

This is a post from Canada.ca’s webinar for newcomers. Make sure you check out all our blog posts on these topics: the Canadian tax system, some of...

What is an RESP? It is a savings account registered with the Government of Canada that earns interest tax-free AND has money from the government put into it...

Filing your taxes every year is important to ensure you are receiving all the government benefits and subsidies you are eligible for. Even if you are not employed...

Do you have to file a return? File a return for 2020 if: You have to pay tax for the year You want to claim a refund You...